our goal

To strengthen democracy, enhance economic growth and reduce poverty in Pakistan

our legacy

The Sub-National Governance (SNG) Programme partnered with the Governments of Punjab, Khyber Pakhtunkhwa, and the Federal Government to strengthen governance and improve public financial management. By enhancing fiscal space, the programme enabled more effective and inclusive service delivery. It led pioneering reforms in budgeting and pensions, and introduced innovative approaches to land-use planning and urban management. Notably, SNG championed sustainable and climate-resilient solid waste management solutions. Through these efforts, the programme helped build stronger institutions and more responsive public services — leaving behind a legacy of citizen-centred, sustainable governance across Pakistan.

our journey

OUR WORK

Planning & Budgeting

Improve how provincial and local governments plan and budget, and follow through with budget execution in an efficient, effective and transparent manner

Institutional Strengthening

Strengthen institutional capacity for governance and public financial management, with a focus on post-Covid recovery and climate change

Fiscal Space Management

Strengthen revenue policy and revenue administration for additional resource generation through tax and non-tax measures

Innovation & Action Research

Improve governance and public financial management through research and innovation pilots

Local Governance

Strengthening local governance across a number of districts in Khyber Pakhtunkhwa (KP) and Punjab to improve resource management and service delivery

Accountability, Inclusion & Transparency

Support the mainstreaming of inclusion, accountability, and transparency in government planning and budgeting processes

our impact

PKR 290 Billion

SNG helps to create physical space of PKR 290 billion

PKR 469 Billion

Punjab retired PKR 469 billion of circular debt on account of wheat subsidy in FY2024 (58% reduction)

82000 Elderly Women

82,000 elderly women receive a monthly cash benefit of PKR 2,000, enhancing their financial security.

PKR 192 Billion

Thorough analysis enabled KP to identify PKR 192 billion in federal receivables that had not yet been paid. KP successfully retrieved PKR 42 billion through NFC reconciliation for NMDs, recalculation of hydel power profits, and FBR and KPRA cross-input reconciliation

An enduring solution to solid waste chaos

SNG’s end-to-end policy cycle support is providing a low-cost indigenous model to manage solid waste with TMA Bahrain and WSSC Babuzai leading the way

PFM laws pending since 1973 enacted

KP and Punjab Public Financial Management Acts fulfill a long-standing constitutional requirement; promote rule-based, efficient, transparent and accountable financial management

Thorough analysis enabled KP to identify PKR 192 billion in federal receivables that had not yet been paid. KP successfully retrieved PKR 42 billion through NFC reconciliation for NMDs, recalculation of hydel power profits, and FBR and KPRA cross-input reconciliation

Punjab retired PKR 469 billion of circular debt on account of wheat subsidy in FY2024 (58% reduction)

82000 elderly women receives a monthly cash benefit of PKR 20,000, enchaining their financial security

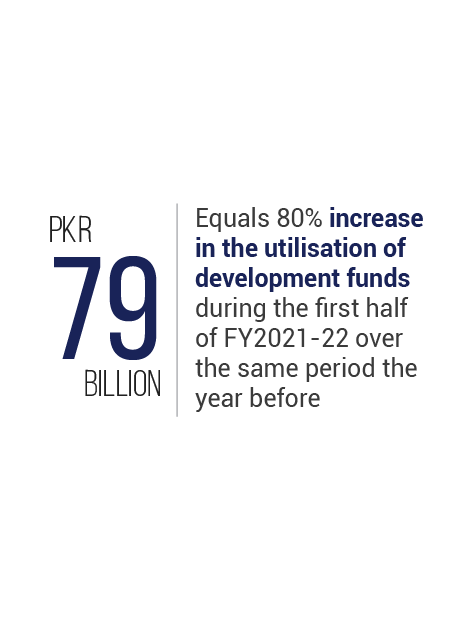

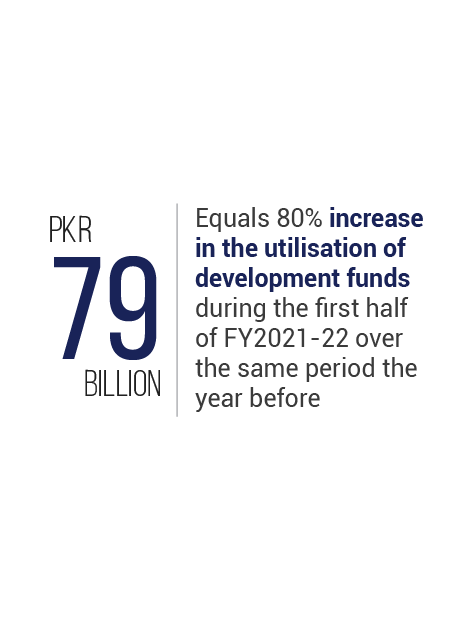

PKR

79

billion

Represents an 80% increase in the utilisation of development funds during the first half of FY2021-22 over the same period the year before

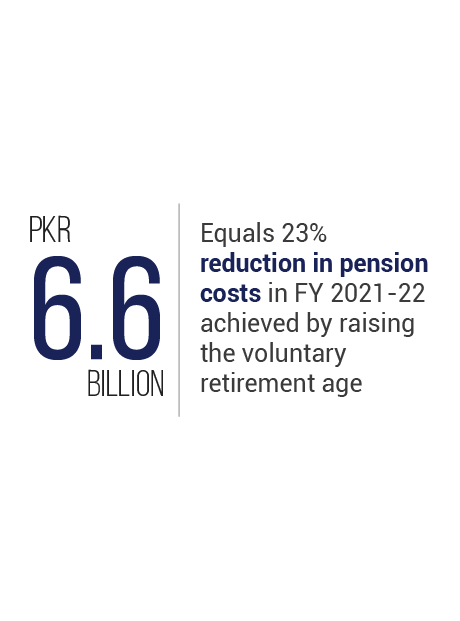

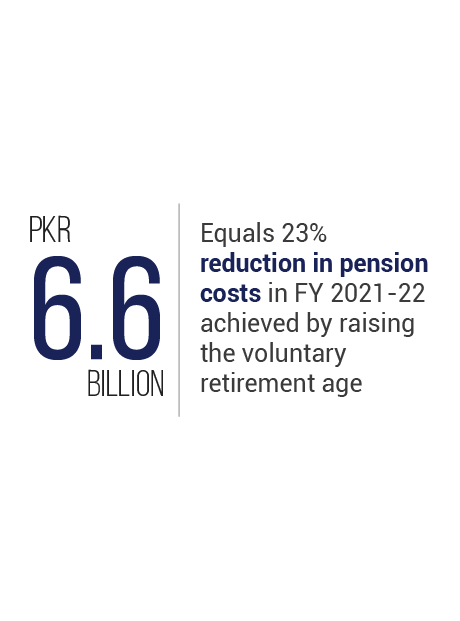

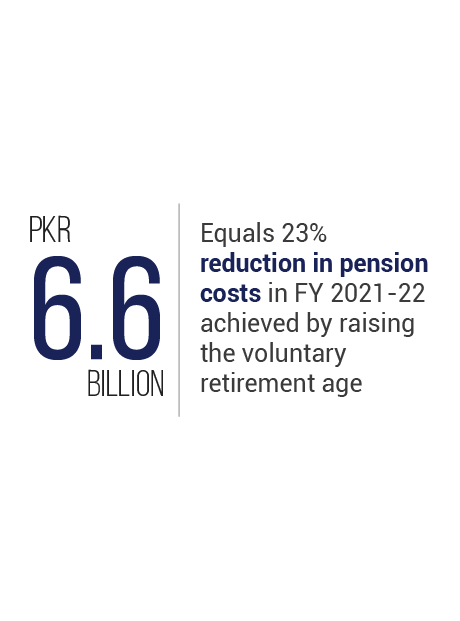

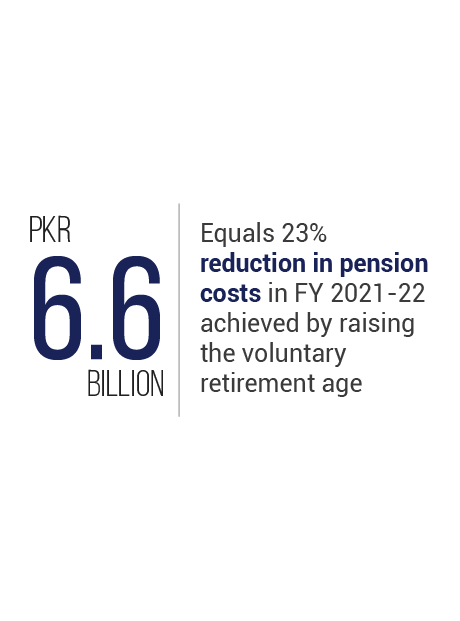

PKR

6.6

billion

Equals 23% reduction in pension costs in FY 2021-22 achieved by raising the voluntary retirement age

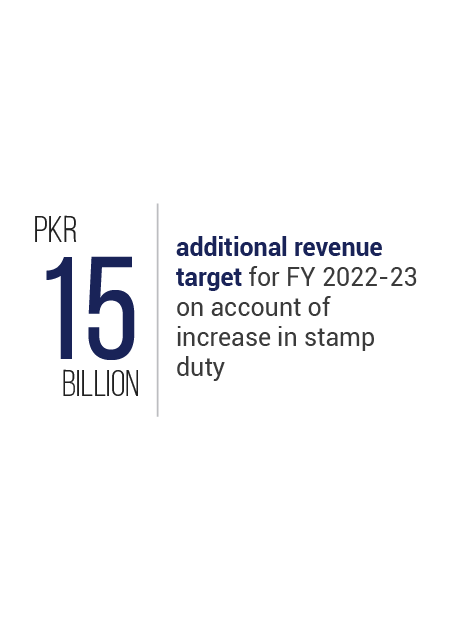

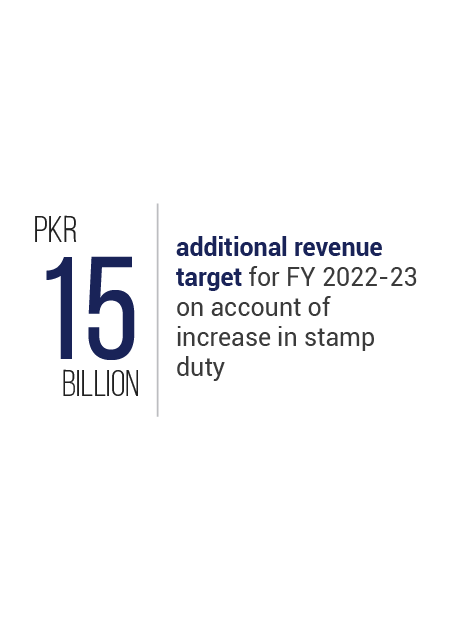

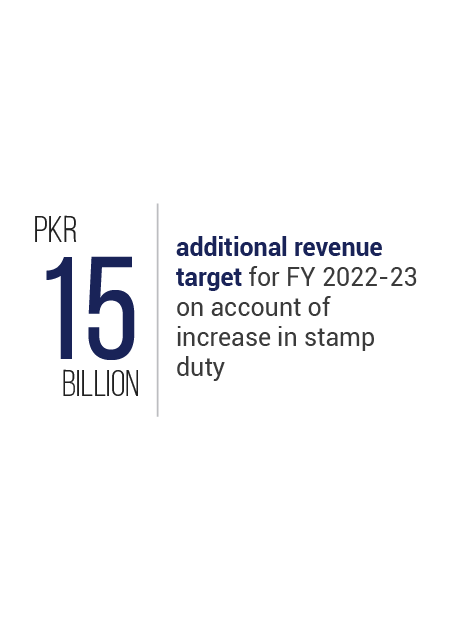

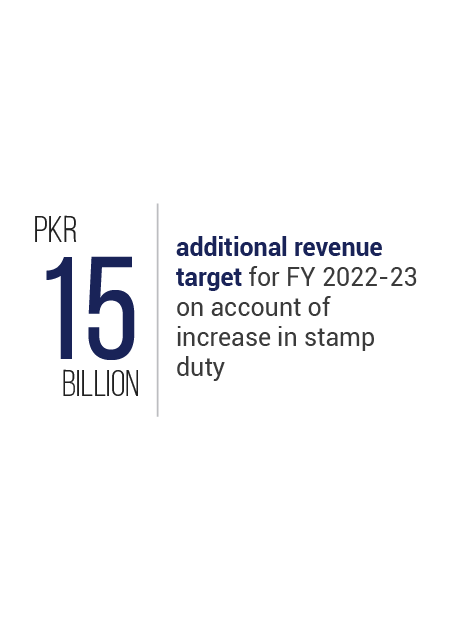

PKR

15

billion

Is the additional revenue target for FY 2022-23 on account of increase in stamp duty

PKR

2.5

million

Is the number of registration requests logged at new Provincial Socio-Economic Registry

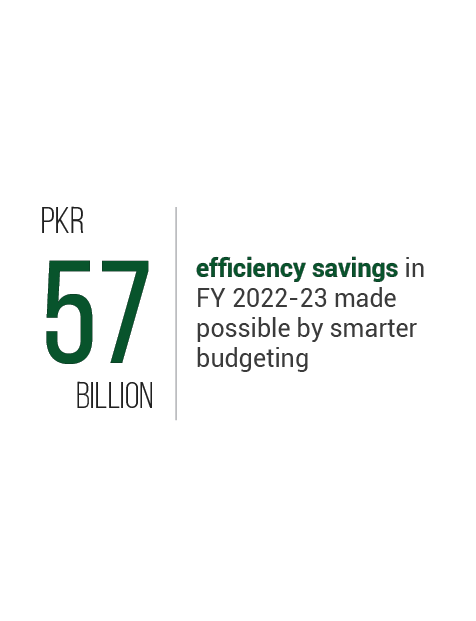

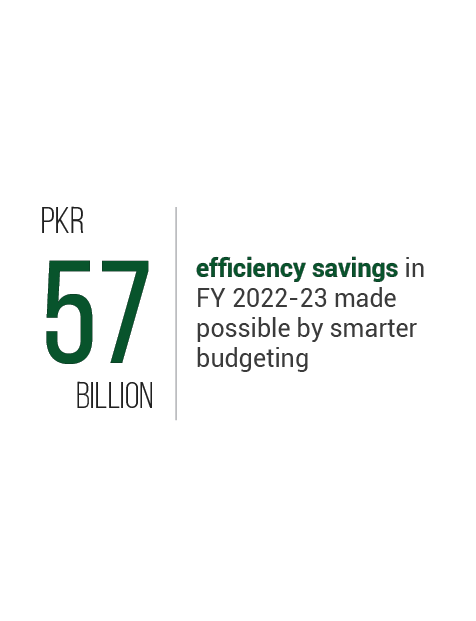

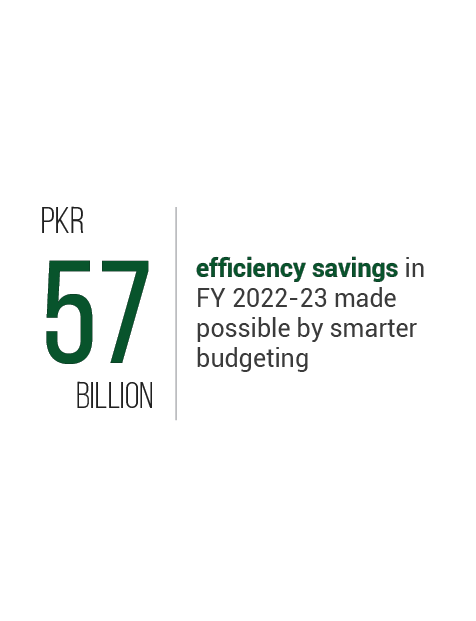

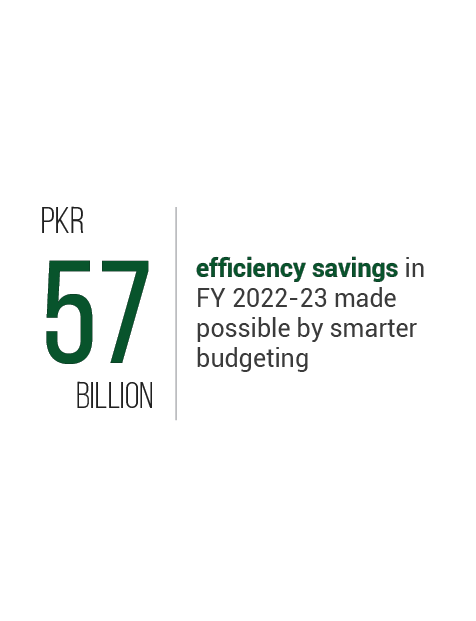

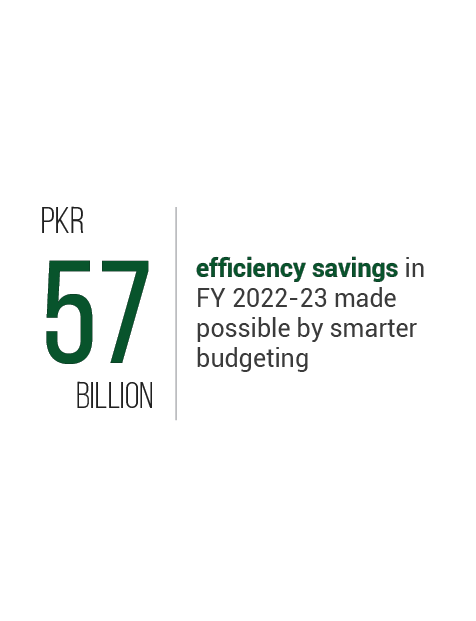

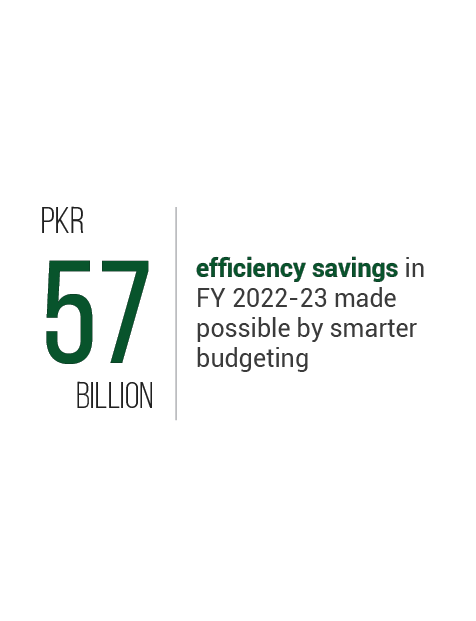

PKR

57

billion

Is the amount of efficiency savings in FY 2022-23 made possible by smarter budgeting

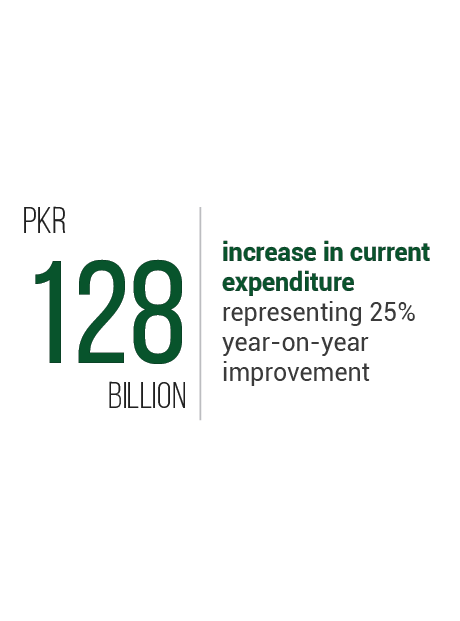

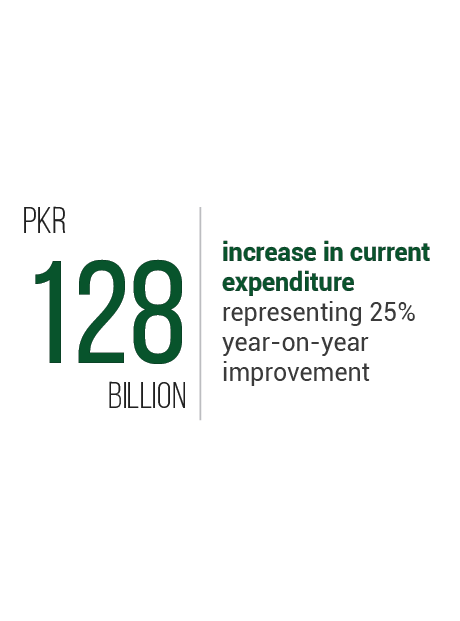

PKR

128

billion

Is the increase in current expenditure representing 25% year-on-year improvement

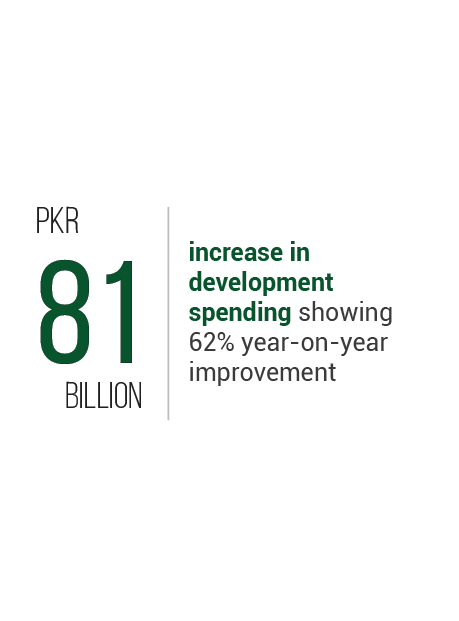

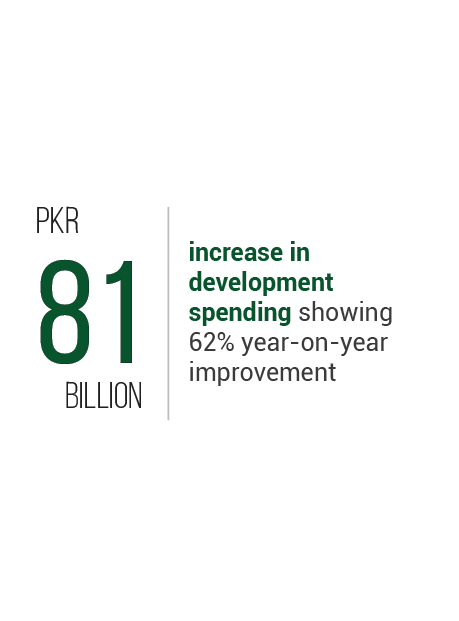

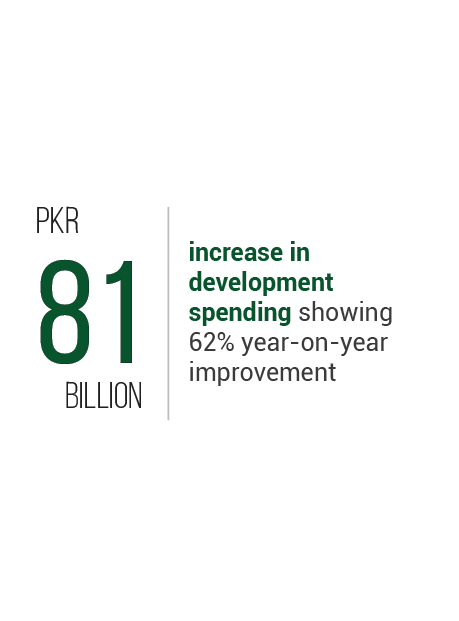

PKR

81

billion

Is the increase in development spending showing 62% year-on-year improvement

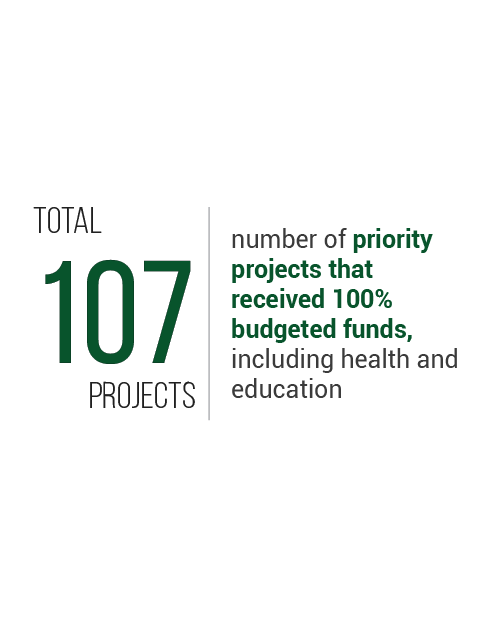

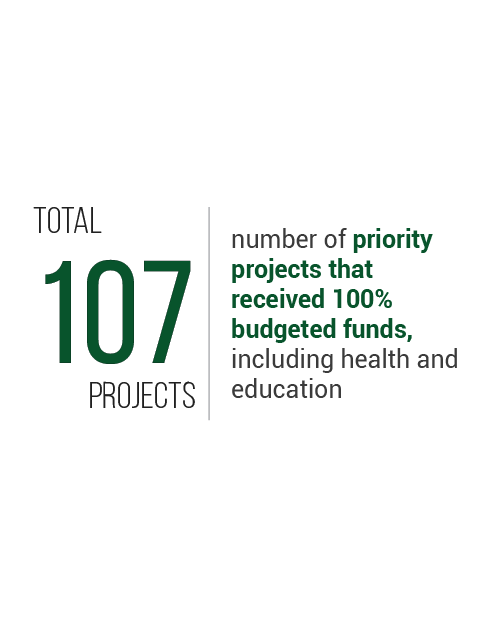

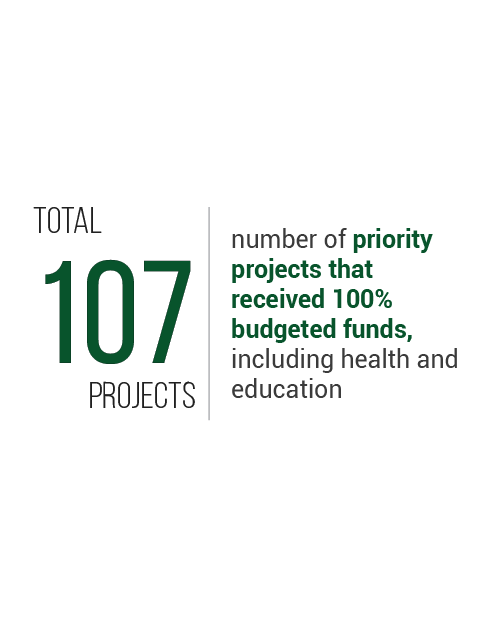

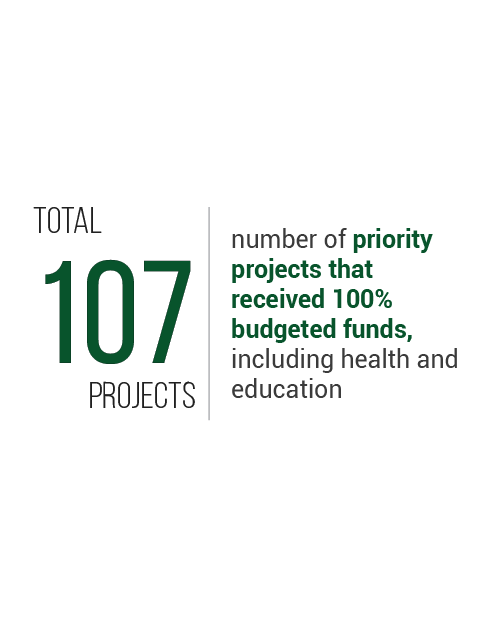

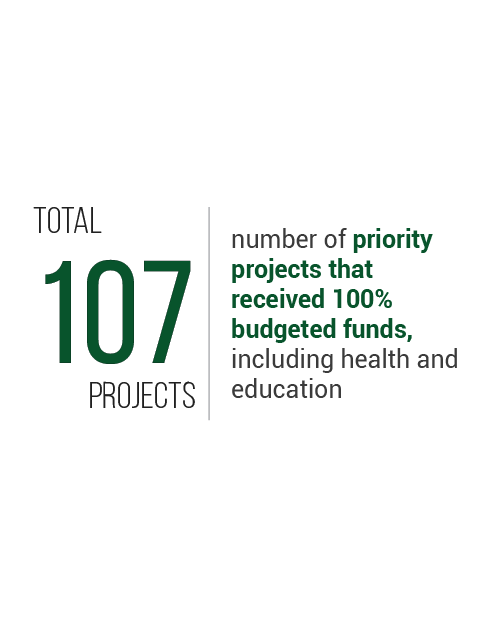

PKR

107

billion

Is the number of priority projects that received 100% budgeted funds, including health and education

OUR CONTRIBUTION TO PUBLIC FINANCIAL MANAGEMENT

Public Financial

Management Act

- Constitutional provisions upheld

- Efficient financial management

- Enhanced fiscal discipline

- Enhanced budget scrutiny by the legislature

KP Debt

Management Act

- Maintaining debt at a sustainable level

- Enhancing fiscal space

- Transparency to the citizens

Punjab Fiscal

Risk Management Framework

- Annual fiscal risk statement mandated as part of the budget

- Legislative oversight and transparency in the management of fiscal risks

Motor Vehicle Tax

(Amendment) Act

- Universal KP number plates

- More KP based registrations

- Enhanced prestige

- Fewer holdups outside the province

Pension Reforms Amendment to Punjab Civil Servants Act 1974

- Minimum Voluntary Retirement Age raised to 55 years

- Resultant pension liability is less by PKR 85.49 billion

Sales Tax

on Services Act

- Sound legal basis for the Sales Tax

- Facilitating businesses

- Enhanced provincial revenue

Reform in Punjab Pension Rules

- Medical certificates and physical appearance replaced with remote biometrics

- Convenience for pensioners

- Error and frauds prevention

Khyber Pakhtunkhwa Revenue Authority (KPRA) Act

- A functionally autonomous KPRA

- Collecting taxes accountably and efficiently

Step towards Treasury Single Account (TSA)

- Zero-Balance Aasaan Assignment Accounts (Punjab)

- Balances from zero-balance accounts returning to the provincial consolidated account

- Improved liquidity