Punjab’s Urban Immovable Property Tax (UIPT) system faces significant challenges, contributing only 6% of provincial tax revenue and 0.05% of GDP, well below the 0.3% average for similar economies, despite its importance in funding urban services.

Reform of UIPT is critical as Punjab’s government struggles to fund essential urban services and infrastructure. Despite widespread recognition of the need for reform, efforts to modernise UIPT until the Sub-National Governance (SNG) programme began working on the issue in 2021.

With SNG support, the government has embarked on bold UIPT reform. This will enhance revenue and improve essential services for Punjab’s urban residents.

A vision for change

Recognising the opportunity for transformative impact, SNG conducted a review of Punjab’s UIPT policy and law in 2022. This showed a system riddled with distortions, including unjustified exemptions, disparities between self-occupied and rented properties, inconsistencies in the taxation of constructed and unconstructed plots, and excessive discretion exercised by the Excise and Taxation Department (E&TD) staff in assessing tax.

Addressing these issues was essential to improve efficiency, equity, and public trust in the system. SNG proposed a shift in approach, from a tax model based on property rental value to one based on capital value. This is aligned with international best practice, ensuring a fairer and more transparent property taxation framework.

Capital value is a well understood concept, making it easier for both taxpayers and administrators to navigate the taxation process. Accurate capital value data is easier to maintain due to the frequent nature of property transactions. This leads to clarity in valuation, improved compliance, fewer disputes, and greater trust in the taxation process.

Capital valuation also enables the taxation on unconstructed land plots. This broadens the tax base and increases revenue, while reducing incentives for land hoarding. It curbs speculative buying and selling, and encourages land development – ultimately boosting housing supply.

The proposal also included a recommendation to replace the exemption of ‘five-marla’ houses with a value-based exemption system. A ‘marla’ is a traditional unit of area, equivalent to approximately 30 square yards. Five marla houses are popular among Punjab’s middle-class families, especially in the province’s sprawling housing societies. Exempting these families was unjustified, and it resulted in around two-thirds of properties being tax-free – an unsustainable strain on Punjab’s finances. The new value-based exemption approach ensures the system favours only low-income families.

Overcoming resistance, building momentum

Reform on this scale is never easy. Throughout the reform process, Punjab witnessed frequent turnover of officials in the E&T Department, and the reform process spanned five successive governments, each bringing its own policy priorities and political considerations. With each leadership change, SNG aligned officials with the reform objectives, established political buy-in, and reaffirmed commitment to implementation.

In this environment, ensuring sustained momentum for UIPT reform required strategic engagement at multiple levels of government. The Resource Mobilisation Committee (RMC), a high-level forum chaired by the Finance Minister, played an important role in maintaining continuity and reform momentum despite political and bureaucratic changes. The RMC repeatedly emphasised the need for UIPT reform, ensuring that the policy shift remained a government priority.

Political leaders were initially hesitant, fearing a public backlash. Managing this resistance required a balanced reform strategy that considered revenue needs with political feasibility. SNG addressed these fears by ensuring the reform could be revenue neutral in the short term, while improving the tax base and fostering equity in the long term.

Punjab’s leadership were committed to boosting own-source revenue, to meet commitments made under the International Monetary Fund (IMF) program negotiated in 2023.

To support the process, SNG developed a transition plan that established a clear transition process, and detailed implementation roadmap.

A historic breakthrough

By early 2024, Punjab reached a turning point as government approved the transition to capital value taxation in the 2024-25 Finance Bill. The Punjab Urban Immovable Property Tax Act (1958) was amended, enabling implementation of the new taxation policy from 1 January 2025.

Under the new system, properties valued at Rs. 5 million (£14,000) or less are exempt from UIPT, while more expensive properties are taxed at gradually increasing rates. These progressive tax rates ensure equity, and ease the financial burden on low-income property owners.

To encourage public acceptance of the new system, it was made revenue neutral in its first year. Existing taxpayers were exempted from any additional tax liability for the second half of FY25, with 50% exemption for newly added taxpayers.

Taxpayers whose liability has decreased under the new system will continue paying the previously assessed tax under the rental value system, with gradual increments until the tax payable under the capital value system equals or exceeds this amount.

The new system introduces mandatory self-declaration of assets and self-assessment of tax. Previously property owners were only liable to pay tax after being served a formal notice. Now, all property owners are liable for tax whether a notice was delivered to them or not. This allows the department to shift its focus away from enforcement towards the audit of self-assessments.

The road ahead

E&TD is rolling out an online portal for property owners to self-declare, and pay tax without having to engage with tax officials. By streamlining tax collection and minimising manual intervention, the portal will strengthen compliance and reduce opportunities for tax evasion.

In parallel, the department is updating its digital property tax records, and linking them to property owners’ national identity card numbers. This will enable authorities identify individuals with multiple properties in different tax jurisdictions who currently benefit from tax exemptions.

SNG is supporting the establishment of a Policy Research and Analytics Unit at the E&TD. This unit will support evidence-based decision-making, providing the analytical muscle needed to refine tax policies, improve compliance, and drive long-term fiscal sustainability.

The long-term impact

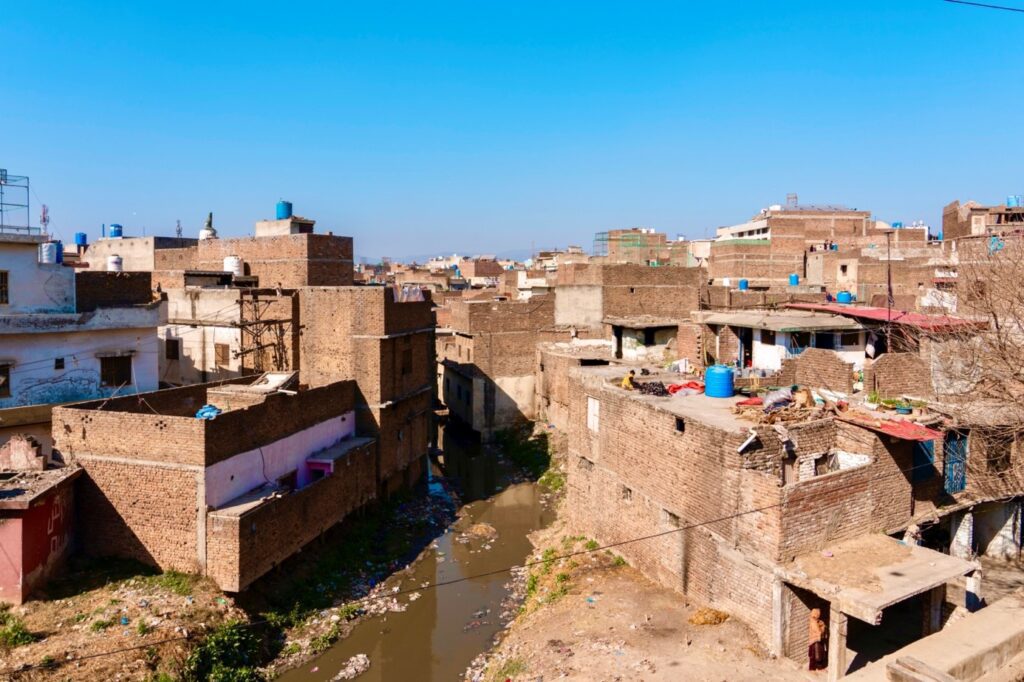

This reform is set to have a significant impact. In the near term, UIPT annual revenue potential is projected at PKR 70- 80 billion (£215 – £246 million). A stronger and more predictable revenue stream will enable local government to invest in essential urban infrastructure, sanitation, and public transport, improving the quality of life of millions of urban residents across Punjab.

This reform is also about restoring trust. Tax compliance in Pakistan has been undermined by perceptions of inefficiency and corruption. By fostering fairness, transparency, and accountability, Punjab is taking concrete steps toward rebuilding public confidence in government.

Once successfully implemented, Punjab’s UIPT reform will serve as a model for other provinces. There is now an impetus for moving towards capital value based taxation in other provinces, with Khyber Pakhtunkhwa just about to pilot it in selected jurisdictions. This reform holds immense potential, strengthening local governance and fostering trust between the Pakistani state and its citizens.